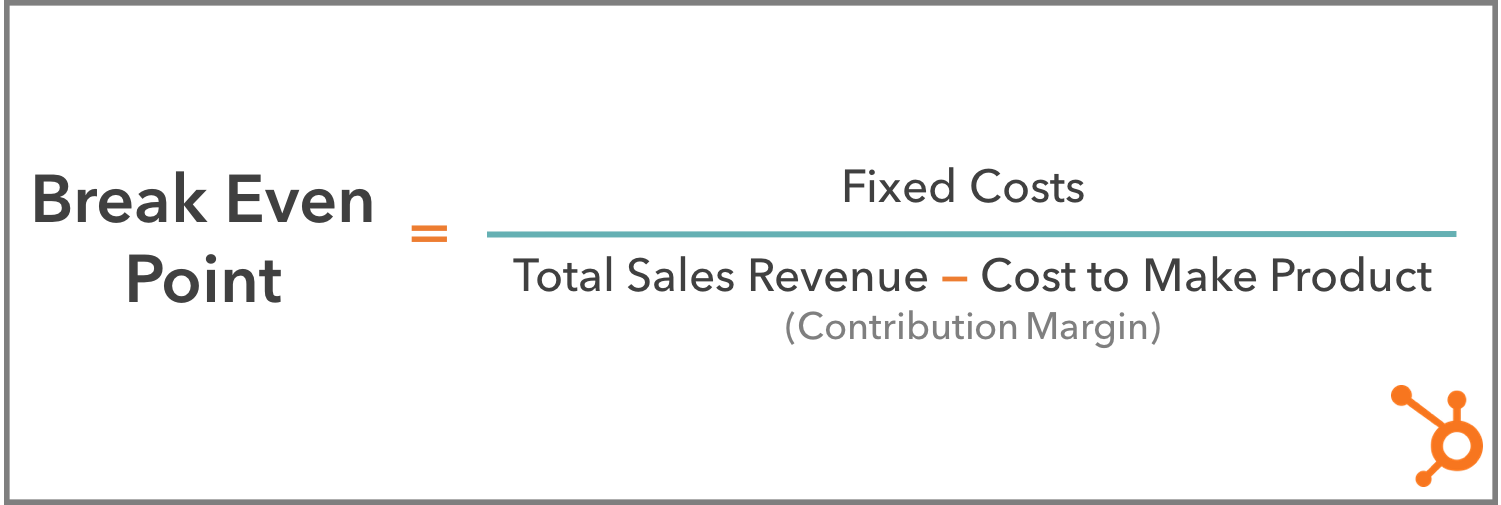

Your break-even point is the place where youre not making any profit. By knowing your break-even point you can determine how many units you need. Variable Costs: These costs will vary depending on the number of cakes being sold. Break-even analysis is arguably one of the most critical functions for any business. Put simply break-even is the point at which your revenues cover your expenses.Website (Setup and maintenance/hosting).With a break-even analysis, you can figure out how much product. Fixed Costs: These costs will remain the same and do not vary depending on the number of cakes being sold. Break-even is the point at which a businesss total costs and total revenue are exactly equal.To take a step back, the contribution margin is the selling price per unit minus the variable costs per unit, and this metric represents the amount of revenue remaining. Hence Break-Even Point (Quantity) 15000 / 5 units. The formula for calculating the break-even point involves taking the total fixed costs and dividing the amount by the contribution margin per unit. The owner of the bakery has estimated all the costs involved and grouped them into two categories: To calculate the Break-Even Point (Quantity) for which we have to divide the total fixed cost by the contribution per unit. Let’s consider an online Bakery that specialises in selling Birthday Cakes online. The following graph explains all the concepts used to find out the break even point: At this point, a business neither earns any profit nor suffers any loss. In Business or Economics the Break Even Point (BEP) is the point at which the total of fixed and variable costs of a business becomes equal to its total revenue.

0 kommentar(er)

0 kommentar(er)